If you are a foreign entrepreneur or investor planning to start a business in Oman, you can now own and operate your company with fewer restrictions compared to the past. This guide explains the full process, legal requirements, business structures, costs, visas, and compliance steps you need to know before launching your company.

Why Start a Business in Oman?

Oman has reformed its foreign investment laws to attract international businesses. Under the current framework:

- Foreign investors can own 100% of a company in most sectors without a local partner.

- The government allows various business structures, including Limited Liability Companies (LLCs), Free Zone Companies, Branch Offices, and others.

- Oman offers a strategic location, a stable economy, and access to the Gulf market.

- The tax environment includes corporate tax, VAT, and no personal income tax (for most individuals).

However, Omanization rules and some regulatory requirements still apply to foreign businesses.

Step-by-Step Company Registration Process for Foreigners

1. Choose the Business Activity

Your first step is to define what your company will do. Oman classifies business activities, and you must choose an activity that is allowed for foreign ownership. Certain sectors are restricted or require special approval (e.g., insurance, real estate brokerage, fishing).

2. Decide on the Legal Structure

Common business structures in Oman include:

- Limited Liability Company (LLC) – Most common for foreign investors.

- One-Person Company (SPC) – Ideal for single owners.

- Branch of a Foreign Company – Only for specific cases (e.g., government contracts).

Each structure has different capital and management requirements.

3. Reserve a Trade Name

You must reserve a unique trade name with the Ministry of Commerce, Industry, and Investment Promotion (MoCIIP). The name must comply with naming rules and include the legal form (e.g., LLC).

4. Prepare Your Documents

Essential documents include:

- Passport copies of all shareholders and directors.

- Articles of Association and Memorandum of Association.

- Proof of physical office space in Oman (lease agreement).

- Feasibility study (if required).

- Power of attorney (if using a local agent).

- Legalized and translated foreign documents (if applicable).

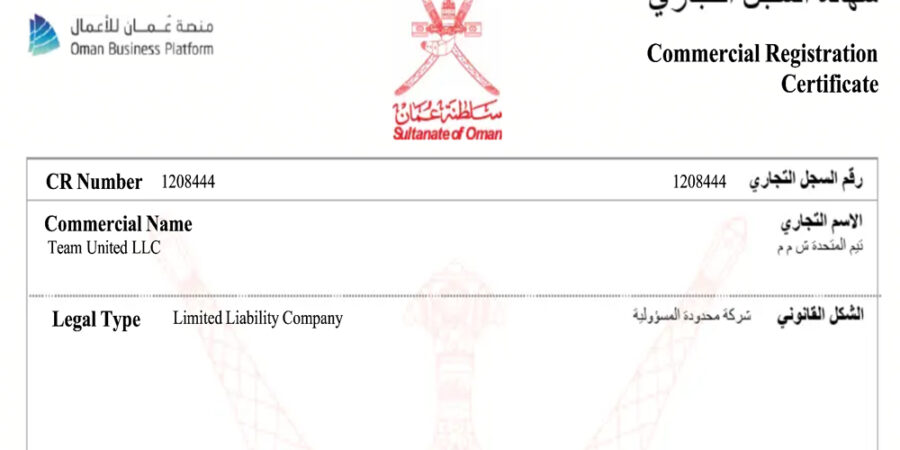

5. Submit Commercial Registration (CR) Application

Apply for a Commercial Registration Certificate (CR) through the Oman Business Platform (formerly Invest Easy). Once approved, this certificate legally establishes your company.

6. Obtain Business License

After the CR, you must obtain a business license based on your activity:

- Commercial License for trading and general business.

- Industrial License for manufacturing.

- Professional License for services and consultancies.

- Sector-specific licenses for tourism, healthcare, real estate, etc.

7. Register with Oman Chamber of Commerce and Industry

Membership with the Oman Chamber of Commerce and Industry (OCCI) is mandatory and your company cannot operate without it.

8. Register for Tax and Labor Compliance

All companies must register with the Oman Tax Authority to obtain a Tax Identification Number (TIN). You may also need to register for VAT if your turnover exceeds the threshold. Additionally, you must register with the Ministry of Labour to hire employees and comply with Omanization rules.

Foreign Ownership Rules and Capital Requirements

100% Foreign Ownership

Under the current law, foreign investors can own 100% of a company in most areas of business. There is no requirement for a local sponsor in most sectors.

Minimum Capital

- Some standard LLCs no longer require minimum share capital before registration.

- Banks may require a realistic deposit before opening a corporate account.

In certain cases (industry-specific) minimum capital is still applied.

Office Address

A physical registered office address in Oman is mandatory for company registration. This can be a leased commercial space or a flexi-desk for service businesses.

Visas and Work Permits

After your company is registered:

- You can apply for an Investor Visa which enables you to live and work in Oman.

- You can sponsor employment visas for foreign staff.

- Dependent visas are possible once investor or employment visas are active.

Be aware: Omanization rules generally require hiring Omani nationals within a year of operation, which is a significant obligation for compliance.

Post-Registration Requirements

Once your company is set up, you must:

- Renew the Commercial Registration annually.

- File corporate tax returns (standard 15% corporate tax).

- Comply with VAT and accounting laws if applicable.

- Maintain proper financial records and audits.

Free Zones and Special Economic Zones

Foreign companies can also register in Free Zones (e.g., Duqm, Sohar, Salalah). Benefits typically include:

- 100% foreign ownership with additional incentives.

- Tax exemptions or holidays.

- Simplified customs and operations.

These zones are ideal for manufacturing, export-oriented companies, or logistics operations.

Risks and Challenges

While Oman offers many opportunities, consider these potential challenges:

- The requirement to hire local staff can increase costs and administrative work.

- Visa and labor quotas may take time to process.

- Cultural and language differences may lead to miscommunications.

- Regulatory compliance and reporting can be complex for first-time investors.

Summary: Key Steps to Register Your Business in Oman

- Choose your business activity and legal structure.

- Reserve a trade name and prepare your documents.

- Submit your Commercial Registration (CR).

- Obtain your business license.

- Register with OCCI and tax authorities.

- Open a corporate bank account.

- Arrange visas and hire employees.

Leave a Reply